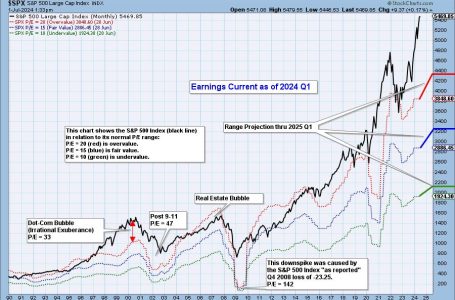

S&P 500 Earnings Results Are In for 2024 Q1 and Market Is Still Overvalued

Peso may move sideways before inflation report

THE PESO may continue to move sideways against the dollar this week as the market awaits the release of June Philippine inflation data.

The local unit closed at P58.61 per dollar on Friday, strengthening by 14 centavos from its P58.75 finish on Thursday, Bankers Association of the Philippines data showed.

Week on week, the peso likewise rose by 19 centavos from its P58.80-per-dollar finish on June 21.

The peso gained against the dollar on Friday after the Bangko Sentral ng Pilipinas (BSP) lowered its inflation estimates and reiterated its dovish stance, Rizal Commercial Banking Corp. Chief Economist Michael L. Ricafort said in a Viber message.

The BSP on Thursday lowered its average baseline inflation forecasts for 2024 and 2025 to 3.3% and 3.1%, respectively, from 3.5% and 3.3% previously.

It also slashed its risk-adjusted inflation forecasts for this year and next to 3.1% from 3.8% and 3.7%, respectively.

Headline inflation accelerated to 3.9% year on year in May from 3.8% in April, but marked the sixth straight month that inflation settled within the central bank’s 2-4% annual target.

For the first five months, the consumer price index (CPI) averaged 3.5%.

The Monetary Board on Thursday kept its policy rate at a 17-year high of 6.5% for a sixth straight meeting, as expected by all 15 analysts in a BusinessWorld poll.

BSP Governor Eli M. Remolona, Jr., at a briefing after their policy meeting, signaled a “less restrictive” stance if there is a sustained improvement in the inflation outlook, adding they are “somewhat more likely than before” to begin their easing cycle by their next meeting, which is on Aug. 15.

Mr. Remolona said they could cut rates by 25 basis points (bps) in the third quarter and another 25 bps in the fourth quarter for a total of 50 bps in easing for the year, depending on data,

The Monetary Board’s Aug. 15 review is its only meeting in the third quarter. Meanwhile, its last two reviews for the year, which will be held in the fourth quarter, are scheduled on Oct. 17 and Dec. 19.

The peso and other Asian currencies mostly consolidated against the dollar on Friday before the release of US personal consumption expenditures (PCE) data later that day, Security Bank Corp. Chief Economist Robert Dan J. Roces said in a Viber message.

US monthly inflation was unchanged in May as a modest increase in the cost of services was offset by the largest drop in goods prices in six months, drawing the Federal Reserve closer to start cutting interest rates later this year, Reuters reported.

The report from the Commerce department on Friday also showed consumer spending rose marginally last month. Underlying prices advanced at the slowest pace in six months, raising optimism that the US central bank could engineer a much-desired “soft landing” for the economy in which inflation cools without triggering a recession and a sharp rise in unemployment.

Traders raised their bets for a Fed rate cut in September.

The flat reading in the PCE price index last month followed an unrevised 0.3% gain in April, the Commerce department’s Bureau of Economic Analysis said. It was the first time in six months that PCE inflation was unchanged.

In the 12 months through May, the PCE price index increased 2.6% after advancing 2.7% in April. Last month’s inflation readings were in line with economists’ expectations.

Inflation is receding after spiking in the first quarter as 525 bps worth of rate hikes from the Fed since 2022 cool domestic demand. Inflation, however, continues to run above the central bank’s 2% target.

Financial markets saw a roughly 68% chance that the Fed’s policy easing would start in September compared to about 64% before the data, though policy makers recently adopted a more hawkish outlook. The US central bank has maintained its benchmark overnight interest rate in the current 5.25%-5.5% range since last July.

Economists were divided on whether the Fed would still reduce borrowing costs twice this year amid solid wage growth. The release of the US employment report for June next Friday could shed more light on the monetary policy outlook.

Excluding the volatile food and energy components, the PCE price index edged up 0.1% last month, the smallest gain since November. That followed an upwardly revised 0.3% rise in April.

The so-called core PCE price index was previously reported to have climbed 0.2% in April. Core inflation increased 2.6% on a year-on-year basis in May, the smallest advance since March 2021, after rising 2.8% in April.

It rose at a 2.7% annualized rate over the past three months, slowing from a 3.5% pace in April.

The dollar index, which measures the greenback against a basket of currencies, was down 0.07% at 105.82 following the PCE data.

For this week, the foreign exchange market could take cues from the release of June Philippine CPI data on Friday (July 5), Mr. Ricafort said.

A BusinessWorld poll of 14 analysts yielded a median estimate of 3.9% for June headline inflation, within the BSP’s 3.4-4.2% forecast for the month.

If realized, the June CPI would be steady from the May print but be slower than the 5.4% pace logged in the same month a year ago.

It would mark the seventh straight month that inflation was within the BSP’s 2-4% annual target range.

Investors will also await the release of June US jobs data on Friday as these could affect the Fed’s policy path, Mr. Ricafort added.

He expects the peso to move between P58.55 and P58.75 per dollar this week. — AMCS with Reuters